Back from the Periphery

Why the BTP/Bund spread could continue to tighten.

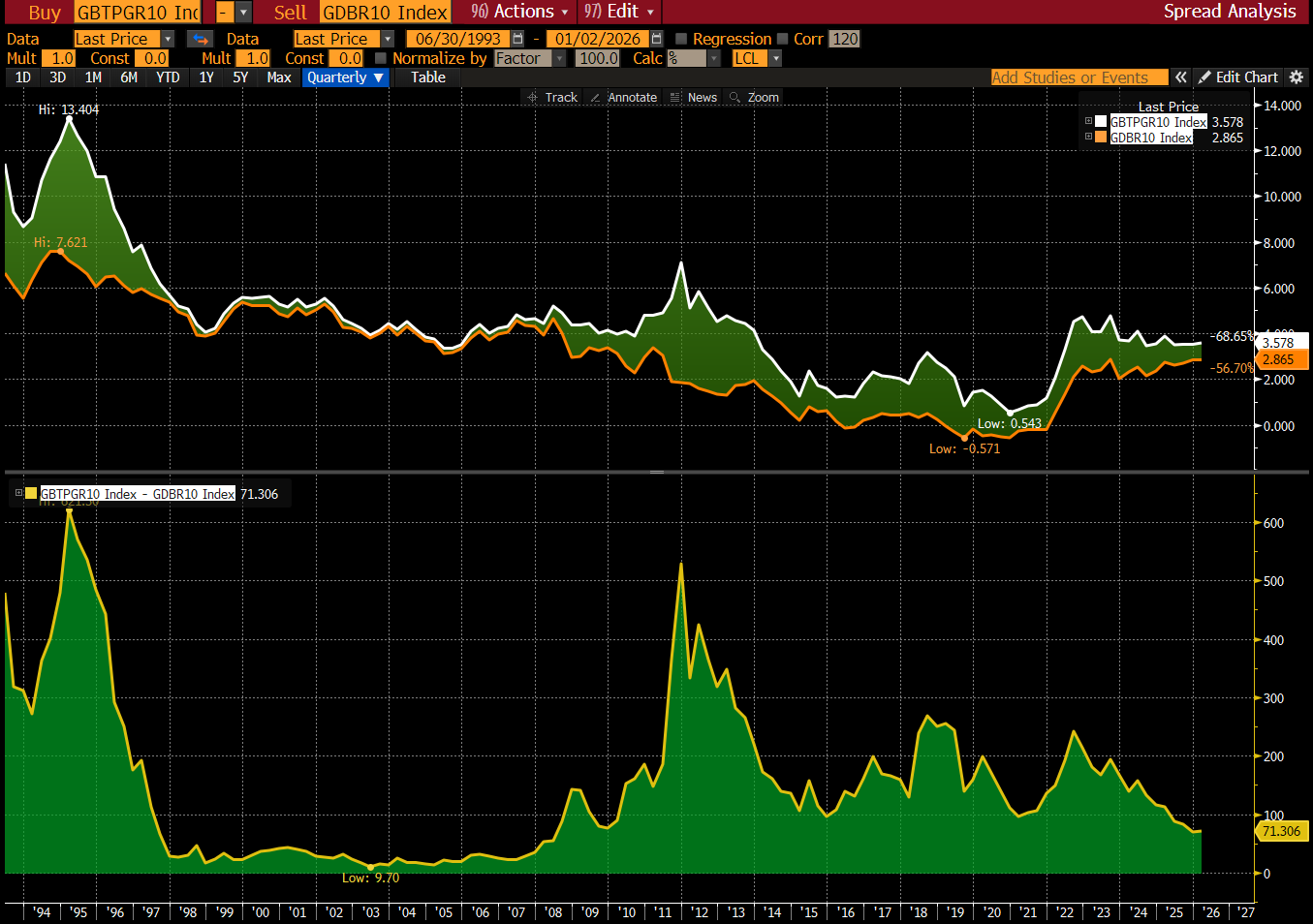

During the holiday break, one move that has snuck under the radar has been the continued decline in the BTP/Bund spread to a 16-year low.

The move is significant because it comes from both legs, namely a move lower in the 10-year Italian bond versus a move higher in the 10-year German equivalent. As such, it points to a growing narrative that previously ‘riskier’ periphery nations in the Eurozone are now much more attractive to own.

On the flipside, infrastructure funding plans in Germany are one factor acting to push up the cost of debt, with other traditional stalwarts like OATs also seeing risk premiums rise.

We think it all sets up nicely for a play to start the year.

If you’re new here and want to see our full FX&Rates portfolio and 2025 performance, click here.