Contrarian Return of the Carry

Why Yen funding could be coming back on tap.

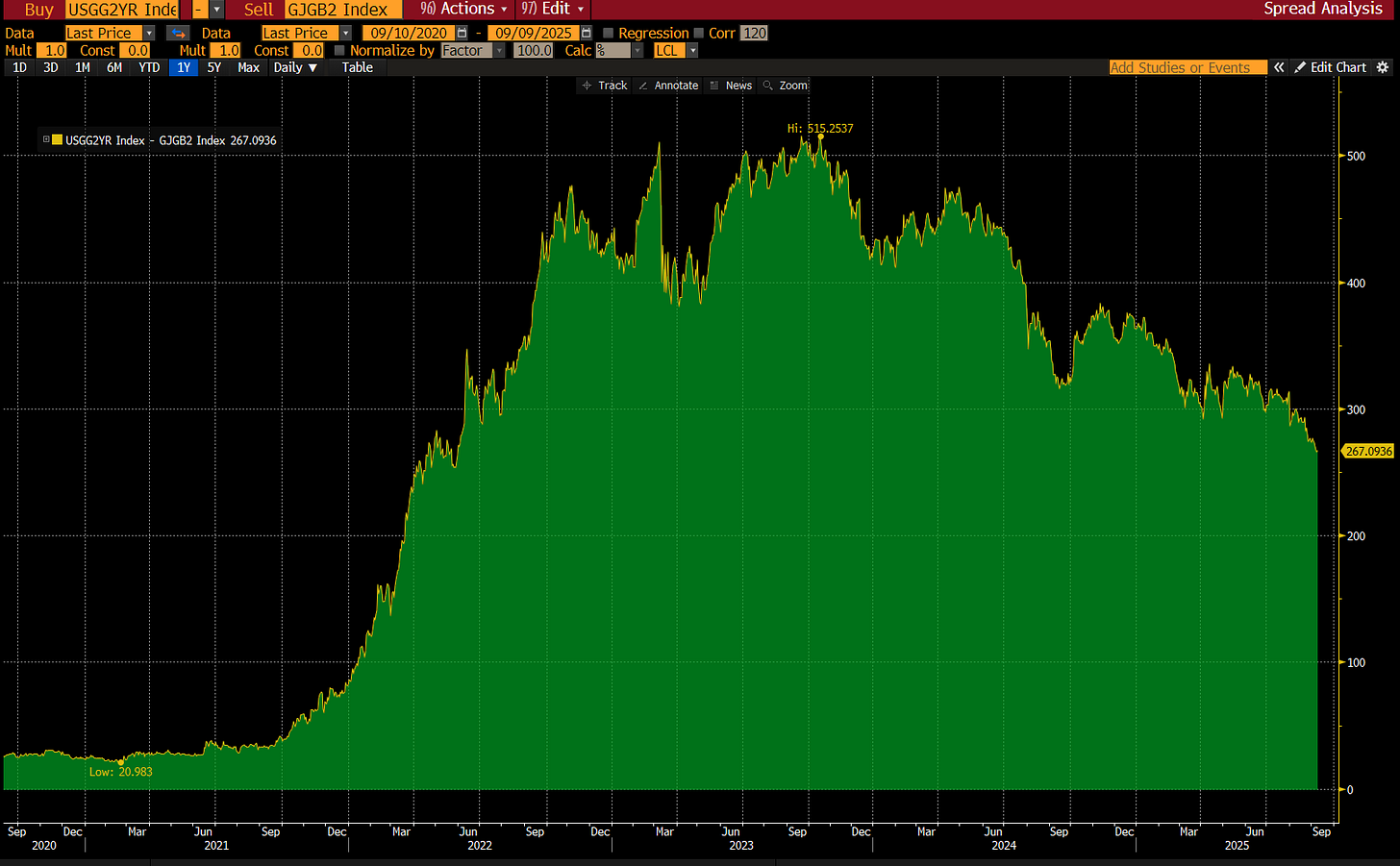

Looking back at USD/JPY between 2022 and 2024, the bulk of the upside was classic carry trade flow: borrow cheap yen to chase higher yields abroad.

Over the past year that dynamic faded, with the pair trading more on positioning and headline risk than rate differentials. Ishiba’s resignation changes the picture. If Sanae Takaichi takes the helm, her clear preference for low rates could reset the stage for carry to come roaring back.

Layer on top the potentially excessive dovish tilt in US rates and you’ve suddenly got the ingredients for USD/JPY to reprice with momentum again.