Impacts Of A Weak USD

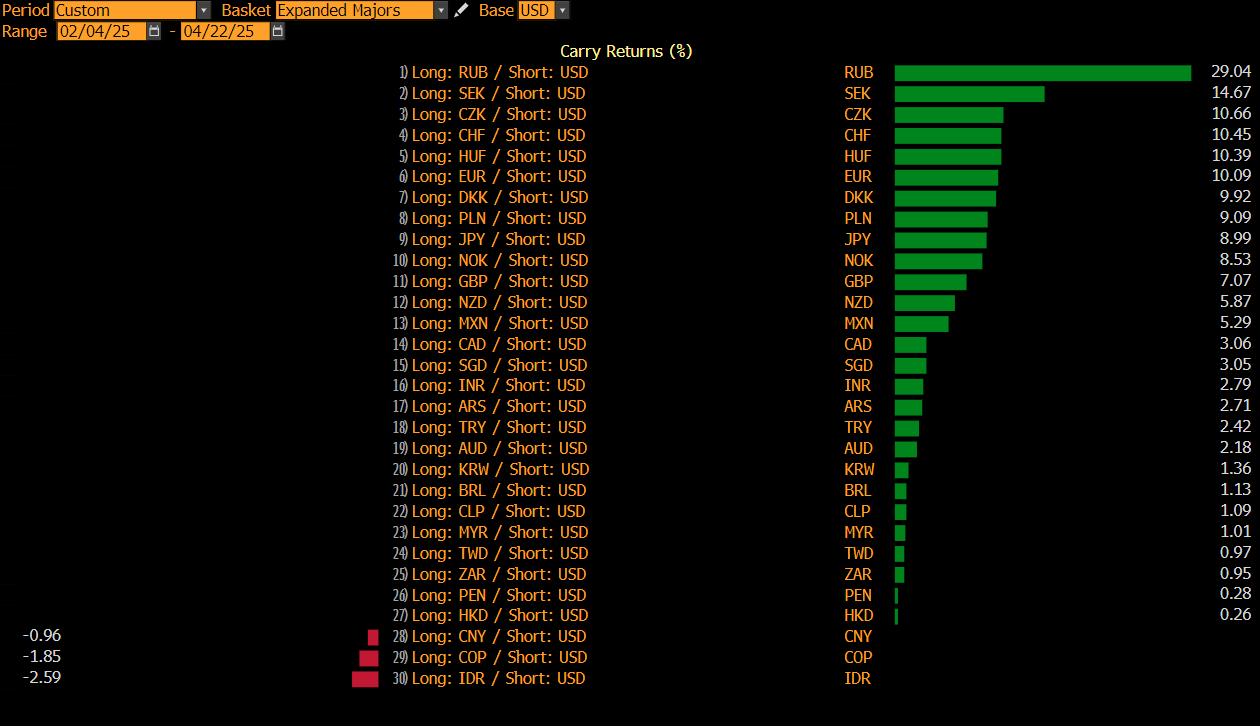

From carry trades to corporate mishaps.

The U.S. dollar index (DXY) may have merely slipped to its lowest level since early 2022, but the speed and scale of the decline since February have surprised many market participants.

The 10.9% slide from recent highs has unsettled speculative long-dollar positions and is now rippling through broader cross-asset markets, triggering unintended consequences across commodities, equities, and corporate earnings.

In this note, we examine the emerging impacts of the dollar’s sharp descent and explore the potential risks if a relief rally fails to materialise in the months ahead.