Yentervention

Clear thoughts on USD/JPY and JGBs.

In late November, we shifted from a bullish USD/JPY stance to a more neutral one. Although we didn’t have any related trades in the portfolio to reflect this shift, we noted at the end that “should we see a further move to the 157-160 region in a short period of time, then the intervention threat becomes real.”

Thanks to the growing likelihood of PM Takaichi calling a snap election, we’ve seen USD/JPY trade above 159.00 today, less than two months after our last note.

Therefore, intervention risk is indeed becoming real, but the broader dynamics beyond a short-term knee-jerk need to be factored in before making any trading decisions.

SUMMARY

We feel strongly that a snap election will be called shortly, with Takaichi winning with a majority, given her approval ratings and domestic soundbites.

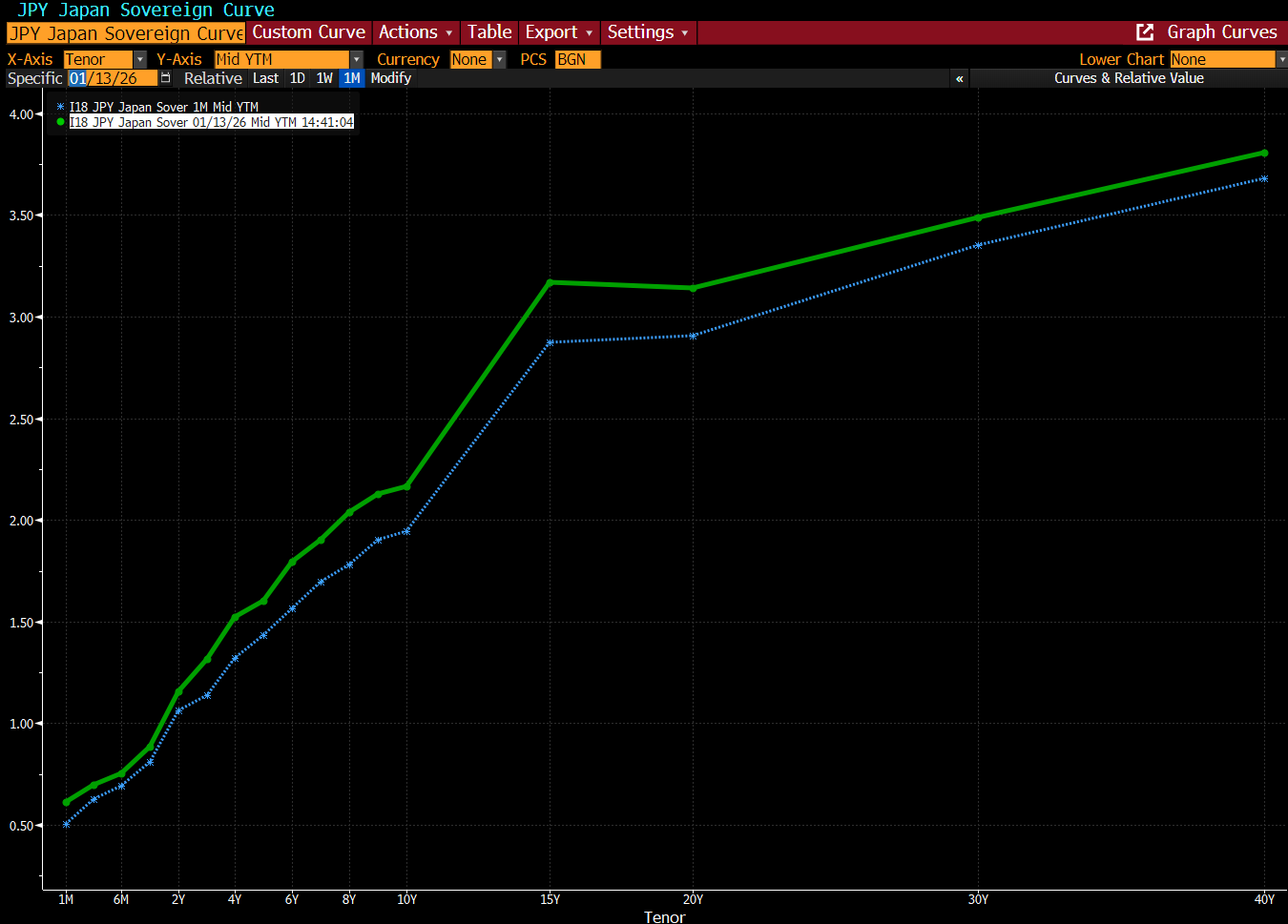

The aggressive expansionary fiscal policies that will likely follow should push both JGB yields (particularly the long end) and USD/JPY higher.

We see little value in chasing immediate upside on the pair in the wake of potential intervention, so prefer to get long on any tree shake.

The State of Play

Over the past few days, speculation has intensified that PM Takaichi is preparing to call a snap general election as early as February 2026, potentially dissolving the lower house at the start of the regular Diet session on January 23 with February 8 or 15 being discussed as possible election dates.

This follows a Yomiuri newspaper report and subsequent Kyodo agency confirmation that Takaichi has signalled her intention to party executives, underpinned by her high approval ratings and a desire to secure a clearer majority for the LDP.

Such a move is seen as a bid to solidify her political mandate, especially given the coalition’s razor-thin control of the lower house.

This is, of course, a bold political move. A prominent recent precedent is the October 2024 snap election called by then-prime minister Shigeru Ishiba. Rather than solidifying his leadership, the election backfired, with the ruling LDP–Komeito coalition losing its lower-house majority for the first time in years (securing only 215 of 465 seats, short of the 233 needed for outright control) and forcing an era of political fragmentation.

In the current context, however, Takaichi’s calculus differs materially from those past setbacks. Since becoming prime minister in October 2025, she has maintained robust public approval (reported in some surveys near 70%), particularly buoyed by her assertive economic and security policy stances that resonate with core conservative voters.

The current LDP coalition sits just a few seats short of a majority in the lower house, creating a strong incentive to seek a fresh mandate.

So do we think an election will be called imminently and that Takaichi will win a majority? Yes.

Policy Problems?

The headache for the Yen thus far, and for JGB yields, is the implications of the victory. You might think that a more politically stable Japanese government would be good for these assets. Yet this ignores the aggressively expansionary fiscal policy that will be implemented.

This implies larger budget deficits and heavier JGB issuance. On the surface level, the impact for higher yields is obvious. Higher expected issuance raises the term premium investors demand to hold long-dated JGBs.

Yet the rising deficit is also a factor, something we spoke about during the November note:

“As of December 2024, Japan had one of the highest debt-to-GDP ratios globally at 237%. For comparison, the US is at 124%.

Japan’s exceptionally high debt-to-GDP ratio becomes more challenging in a rising-yield environment because even small increases in borrowing costs feed directly into a large stock of outstanding obligations.

While Japan’s long average maturity profile slows the pass-through, higher JGB yields ultimately force the Ministry of Finance to devote more revenue to interest payments, limiting flexibility around social spending, defence, and growth initiatives. This fiscal tightening bias matters for markets because it influences how aggressively the Bank of Japan can normalise policy.”

So you then have broader fiscal sustainability concerns, which kick long-dated yields higher, with the 30yr the typical benchmark where economic viability concerns are expressed. Even if the BOJ caps front-end rates, the long end remains the release valve.

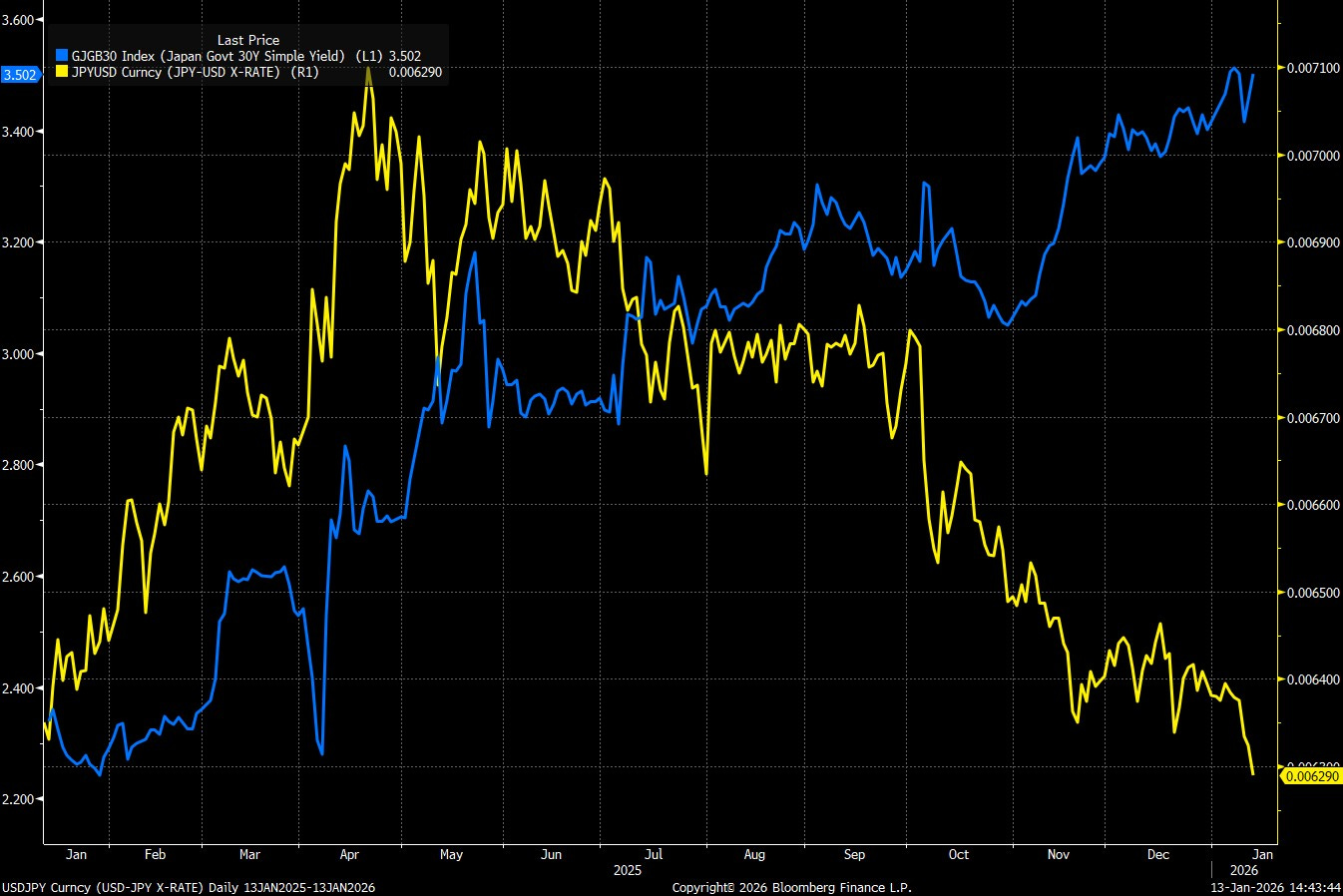

At the same time, fiscal expansion weakens the yen through both relative-rate and confidence channels. Higher domestic yields driven by fiscal stress are not automatically yen-supportive if they are perceived as risk-premium driven rather than growth- or productivity-driven.

Markets are interpreting unfunded stimulus in Japan as reinforcing the long-standing mix of rising debt stock. We’d expect data to show capital outflows with Japanese institutions seeking more stable real returns abroad, further weighing on the Yen.

FX Intervention is Coming

We all know the party line. The MoF isn’t bound by a specific level at which to intervene; it depends on the pace and volatility of any move.

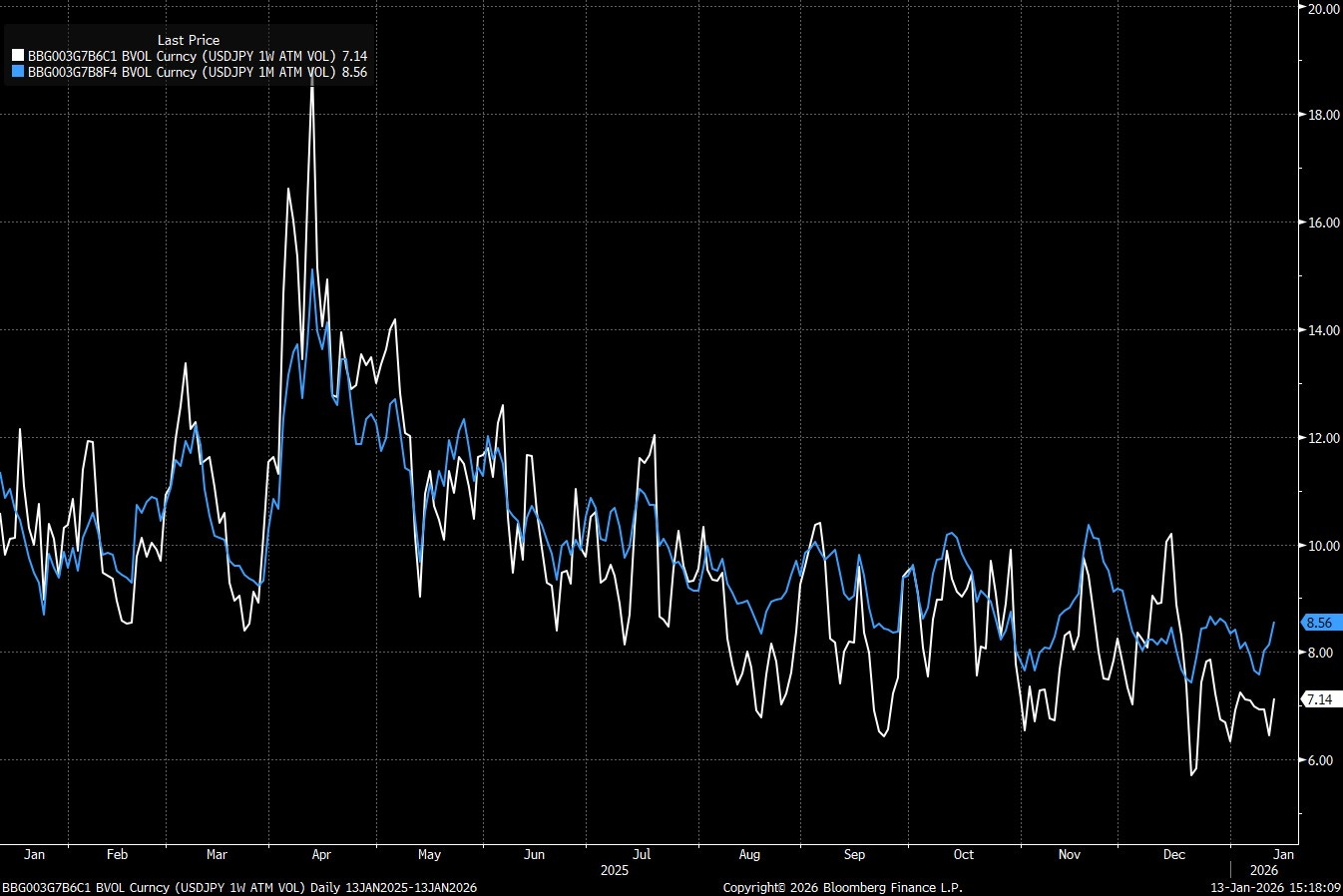

So, although a break of 159.00 isn’t the catalyst for intervention today, there are signs that a one-sided sharp move through 160.00 and up to 162.00 in the space of a month could see a trigger for activity, based on the above reasoning, along with a spike in RSI overbought levels and the line in the sand from the 2024 highs.

Japanese officials have escalated their warnings, with Finance Minister Satsuki Katayama publicly stating that she and U.S. Treas Sec Scott Bessent share concerns about the yen’s one-way weakness. So we’ve had a tick in the box for verbal interventions, with these comments implicitly broadening the possibility of joint or at least coordinated action should disorderly conditions deepen.

Deputy Chief Cabinet Secretary Masanao Ozaki has also indicated that authorities stand ready to act if moves become speculative or deviate from economic fundamentals.

Implied ATM options vol is very telling. The one-week gauge hasn’t reacted significantly, while the one-month tenor has shown a larger move. This leads us to conclude that intervention could be on the cards, but the risk of it in the coming days is slim.

The Trade

Being short and waiting for intervention is a high-risk strategy that puts a trader the wrong side of the funding book.

Rather, we’d prefer to sit on our hands and risk missing some limited upside, and then add longs after an intervention bout.

After all, the fundamentals around a clear election victory and the policies that could follow should send USD/JPY higher over the course of 2026, regardless of what ammunition the MoF uses.

APFX.