Portfolio Trading Performance

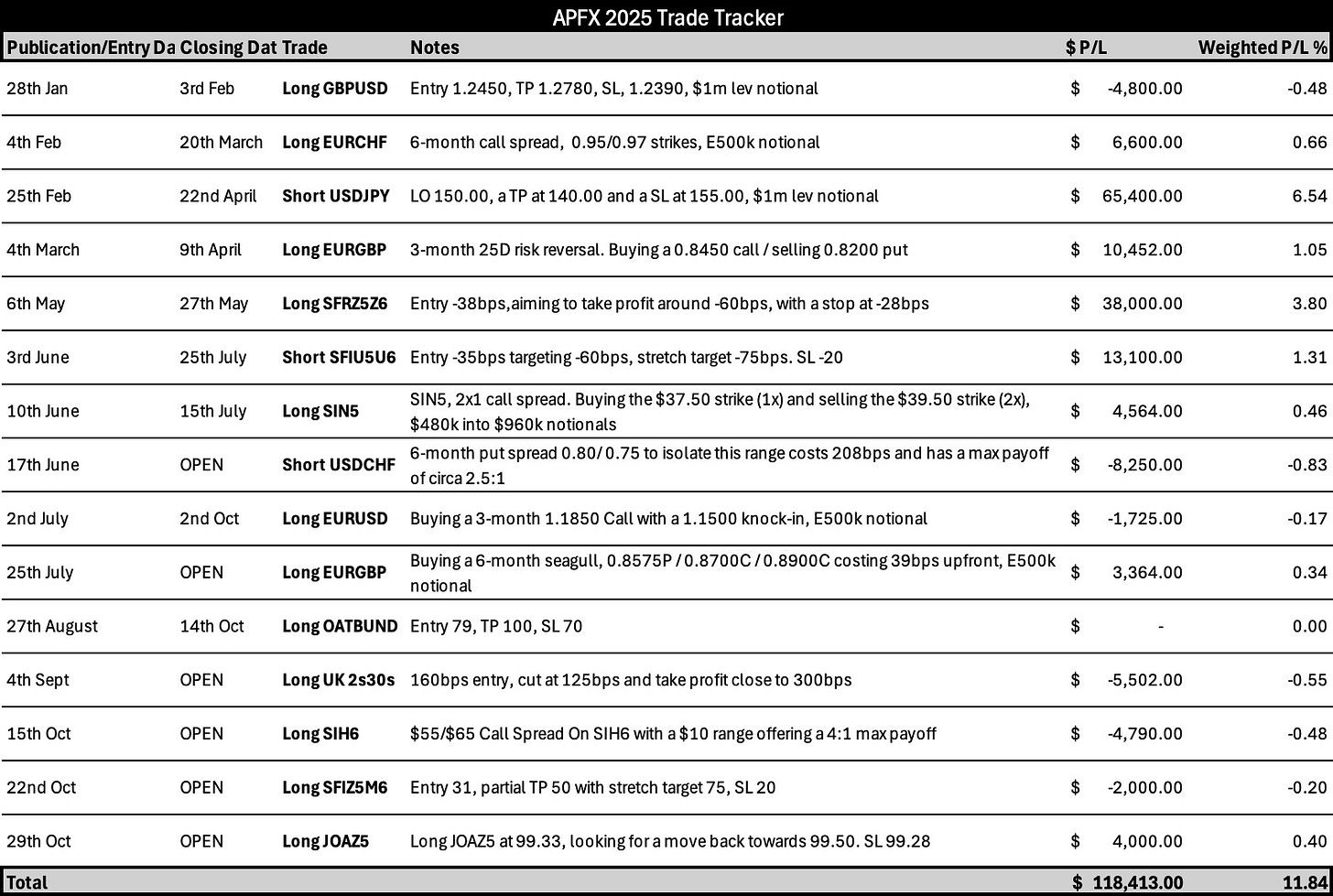

APFX Trade Tracker — 2025

Over the course of the year, we have provided FX & Rates commentary, as well as actionable trade ideas, to our broad set of professional and institutional clients.

As we near the final leg of the year, we would like to share an update on the performance of the portfolio. Each of the specific trade notes can be referenced by its publication date for more detailed reasons behind the structure.

Performance is accurate as of the London open on Monday, 10th November, with the portfolio starting on a $1m base. The portfolio utilises leverage and is designed to offer uncorrelated returns to any single asset class, thereby becoming an absolute return fund.

This is the first instalment of our tracked portfolio. Trade management will also be reflected in real time through the chat, with weekly notes continuing to highlight positioning and P/L.

For the next 7 days only, we’re offering a 30% discount to new subscribers. It’s the only time APFX has (and will) go on sale this year.

Performance

YTD: +11.84%

Including open trades, we’ve had a 66% hit rate this year, with a pretty even split of positions between FX and Rates.

Our two major wins occurred in H1, with our short USD/JPY spot trade being one of only two spot positions taken throughout the year. Our SOFR Z5Z6 play also worked out a treat, although if anything, we could have left this to run even more.

We didn’t have any significant losses to report, but four of our open trades are affecting performance, so let’s review everything we have open right now.

The Open Book

Our oldest live trade, originally put on back in June, is expiring next month. We felt that the momentum behind a stronger Franc would continue, with it also serving as a good hedge against broader macroeconomic themes unfolding.

The 0.80 / 0.75 range has been traded within for a good period of H2, and given the time left to run, we’ll hold this out, even if it likely expires worthless.

Mainly a play on the BoE having to loosen policy faster than expected, with general GBP weakness helping to push EUR/GBP higher this year. We would like to hold this over to the upcoming budget, which has the potential to bring us closer to 0.8900, where we’d look to close the structure.

We reiterated our bearish view on UK assets in September, opting for a rates play this time and looking for the 2s30s to steepen amid fiscal worries. We’re underwater from our entry, but again look to hold this over the UK budget and immediate aftermath.

We don’t think the bull run in silver is finished, as it remains supported by industrial demand, continued debasement trade rhetoric, underowned positioning, and physical tightness. The dip over the past week has been bought, and we think fresh all-time highs are close by.

Given the amount of one-way UK exposure we have on the book, this is one trade we may consider closing to avoid excessive risk. In isolation, this remains a strong trade for those who agree that the hangover from fiscal problems in the UK will likely force the BoE to cut twice in H1 2026.

We’re sitting slightly contrarian on this one, but the backdrop of recent politics and economic data releases means our gut tells us the BoJ won’t increase the base rate in December.

Thoughts to Year End

The UK budget, announced on November 26th, remains one of the key risk events we’re watching for the portfolio. The situation in the UK is dire and is likely only going to be compounded by tax hikes. Although some argue that this negativity is being priced into UK assets, we disagree and believe that any relief rally following a less-negative-than-expected outcome will quickly fade.

Aside from that, we are interested in AUD/JPY and adding some carry for the portfolio (maybe via forwards) to run over into 2026, and will likely write on this in more detail shortly.

Regarding the US, the OIS curve has 16bps of implied cuts priced for the December FOMC. My colleague Jesse Williamson put out a good note here on why implied pricing likely falls closer to 50% in the short term. Even with the potential for the government shutdown to end this week, it’ll likely take some time before backdated and murky data releases come out. Right now, we don’t see a play on December rate pricing, but acknowledge we may see some mispricing to take advantage of in the coming weeks.

Finally, don’t rule out a continued run higher in precious metals. The flush out on gold and silver last month was nothing more than a healthy correction as part of a broader rally. We feel it would be unwise to be short.

Hope you enjoyed the note today.

APFX